Cold Email Case Study

$24M in Sales for a Commercial Real Estate Company (Campaign So Effective, Reachoutly Had to Pause It)

Category

Appointment setting

Industry

Real estate

Headquarters

Phoenix, Arizona

Duration

2 Months

100+

Qualified leads

40

Meetings booked

200M

Capital raise

About Big Property Investments

Big Property Investments specializes in high-value commercial real estate development projects. Led by Founder & CEO Jordan Walker, they focus on large-scale infill development opportunities. Their flagship project involves a 40-acre Sacramento land parcel with sponsored entitlements for 1,000 apartment units plus 820,000 sq. ft. of commercial space.

How the Partnership Began

Jordan Walker already had an established client base but recognized the need to expand his sales reach for high-ticket commercial real estate deals.

After researching Reachoutly’s track record with complex, high-value projects like the $17M ERC campaign, Jordan immediately saw the perfect fit.

He needed an agency with proven experience in high-ticket industries who could operate independently without management oversight. Rather than lengthy negotiations, Jordan sent an agreement without even requiring a meeting.

He wanted Reachoutly to handle the entire outreach system for reaching commercial real estate investors, developers, and family offices across the nation.

The Challenge

Big Property Investments faced a complex set of obstacles while pursuing investors for their Sacramento development opportunity.

High-Net-Worth Investor Identification

Big Property Investments needed to reach qualified commercial real estate investors and developers for their Sacramento development project. While they had existing relationships, the scale of this opportunity required systematic outreach to REITs, property development firms, and family offices nationwide.

Capital Capacity Verification

The challenge was identifying decision-makers at organizations with the capital capacity and strategic interest in large-scale infill development projects, particularly those focused on mixed-use apartment and commercial developments.

Exclusive Market Access

This project required precision targeting within the exclusive commercial real estate investment community, demanding research beyond traditional B2B databases to reach the right stakeholders.

Sophisticated Messaging Balance

Creating messaging that conveyed the sophisticated investment opportunity without overwhelming prospects with technical details, ensuring the right tone for high-stakes conversations.

I needed someone experienced in high-ticket industries who would need no management oversight. Reachoutly was the perfect fit.

Jordan Walker, Founder & CEO

The Solution

65

Google workspace

22

Domains

1

Campaigns

1,000

Emails per day

We developed precision infrastructure specifically targeting high-net-worth real estate investors with the capital capacity and strategic interest for Big Property’s 40-acre Sacramento mixed-use development opportunity.

Specialized Database Research for Elite Targets

We conducted extensive research using specialized commercial real estate databases including Crunchbase, REITnotes, SWFInstitute, REITsAcrossAmerica, REIT.com, Clutch.co, and GeoLN to identify top REITs, real estate developers, and property development family offices.

This approach was essential because traditional B2B databases don’t capture the exclusive commercial real estate investment community where deals of this magnitude happen.

Multi-Stakeholder Decision-Maker Enrichment

We enriched 3-5 decision-makers per organization using Apollo, targeting investment committee members, portfolio managers, and senior executives with deal authority.

This multi-stakeholder approach was crucial because real estate investment decisions typically involve multiple stakeholders, and reaching the right combination increases deal probability.

We validated the entire dataset using Reoon to ensure a maximum 3% bounce rate.

Premium Infrastructure for High-Value Outreach

We built a precision-focused cold email system using 65 Google Workspace accounts across 22 domains, designed for 1,000 daily emails targeting high-net-worth prospects.

We prioritized deliverability over volume in our infrastructure because maintaining reputation in the exclusive commercial real estate community was critical for $24M deal conversations.

Cold Email Infrastructure

Google Workspace (SMTP): 65 accounts

Domains: 22 random short domains

Cold Email Tool: Instantly.ai

Lead Source: Apollo.io, Crunchbase

Sophisticated Campaign Segmentation

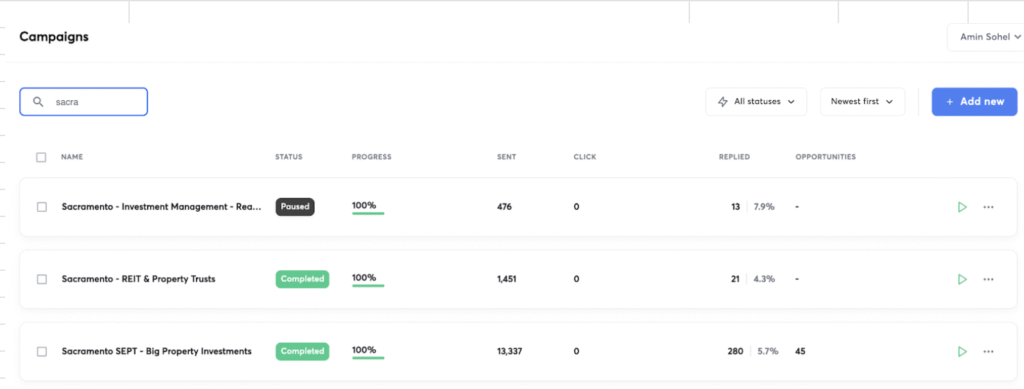

We launched three distinct campaigns targeting different investor profiles.

- REITs focused on apartment developments.

- Commercial developers specializing in mixed-use projects.

- Family offices with real estate portfolios.

We implemented this segmentation because each investor type had different investment criteria, risk profiles, and decision-making processes.

Cold Email Campaign

Copywriting: ChatGPT

Personalization line: Clay, SheetGPT

Campaign duration: 3 cold email campaigns from September 2024 to October 2024.

Premium Positioning and Personalization

Using ChatGPT for copywriting and Clay/SheetGPT for personalization, we crafted messages that positioned the Sacramento project as an exclusive investment opportunity rather than typical sales outreach.

This premium positioning was essential for maintaining credibility with high-net-worth investors who receive numerous investment pitches.

The Results

100+

Qualified leads

40

Meetings booked

24M

Sales

Premium outreach to high-net-worth commercial real estate investors delivered overwhelming meeting volume and major deals.

Campaign Performance

Real estate investor outreach results that exceeded capacity expectations.

- 1,000 emails sent daily across a 2-month period.

- 100+ qualified leads generated.

- 40 meetings booked with decision-makers.

- 4 high-value clients engaged in serious discussions.

- We paused the campaign due to overwhelming meeting volume.

Lead Quality

High-net-worth investor profiles targeted for the Sacramento development project.

- REIT decision-makers.

- Commercial developers.

- Family office executives.

- Prospects capable of $24M investments.

Business Impact

Revenue and partnership outcomes for Big Property Investments’ growth.

- $24M primary deal moving to closing in June, 2025.

- $200M capital raise discussions initiated.

- Premium client pipeline established.

- Systematic investor outreach replacing manual networking.

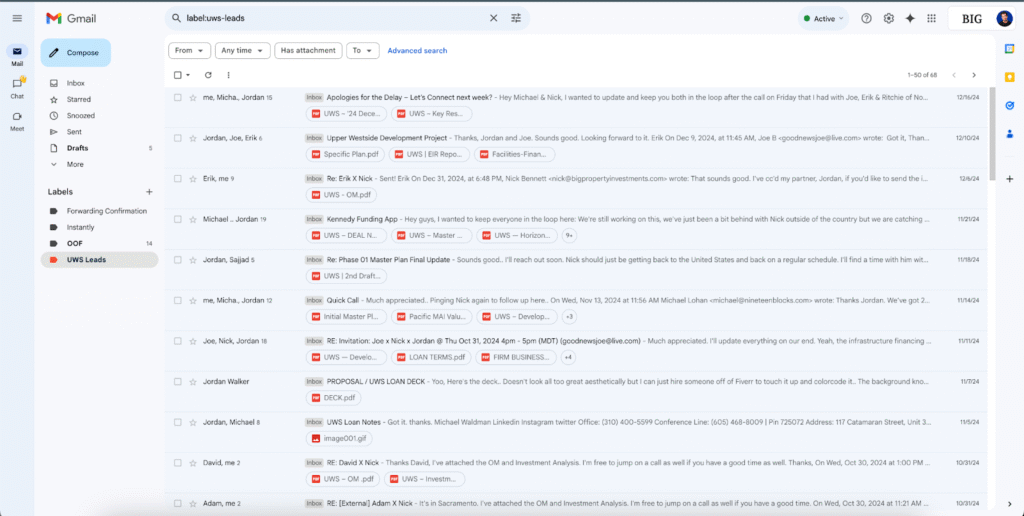

Master Inbox of Jordan

Why It Worked

We understand that commercial real estate operates differently from traditional B2B sales. By building precision infrastructure focused on quality over quantity, we ensured every message reached the right decision-makers without triggering spam filters that could damage Jordan’s reputation in the tight-knit investment community.

Our research methodology was crucial. We used specialized databases like REITnotes and SWFInstitute allowing us to identify prospects that traditional lead generation tools miss entirely.

The messaging strategy made all the difference in this exclusive market. Rather than typical sales outreach, we positioned the Sacramento development as an exclusive investment opportunity, emphasizing the sponsored entitlements and strategic location advantages.

Each message was crafted to speak the language of sophisticated real estate investors, focusing on IRR potential, market timing, and development upside rather than generic property benefits.

Most importantly, our approach to relationship building created a sustainable pipeline beyond the immediate $24M in sales. The 40 high-quality meetings we generated weren’t just prospects. They became the foundation for Jordan’s $200M capital raise discussions and long-term investor relationships that will fuel future development projects.

Launch Your Cold Email Campaign Today!

We’ve generated $39M+ in client revenue through systematic outreach.

Your industry opportunity is next.